WTF Dailies September 15, 2025

US stock futures were flat Sunday evening as Wall Street turned its attention to a pivotal Federal Reserve meeting later this week.

- US stock futures were flat Sunday evening as Wall Street turned its attention to a pivotal Federal Reserve meeting later this week.

- Weak labor market signals coupled with price increases have increased expectation that the Federal Reserve will move forward with an interest rate cut at Wednesday’s policy meeting. Fed funds futures are now pricing in a 96% chance of a quarter-point cut ahead of the upcoming rate decision.

- A rate cut could provide another tailwind for equities, particularly as AI enthusiasm continues to drive market sentiment, despite spreading fears of an AI bubble. Traders will also be watching whether Stephen Miran is sworn in as a Fed governor in time to participate in this week’s FOMC vote.

- Most Asian share markets were steady on Monday after strong gains last week, with South Korea touching fresh record highs and China holding near decade peaks, even as factory output and retail sales data undershot expectations.

- Blue-chip Chinese stocks led gains amid choppy trades, as tech stocks extended their rally, tracking Wall Street’s renewed optimism around AI.

- All three benchmark U.S. stock indexes reached record highs last week, buoyed by expectations that the Federal Reserve would reduce interest rates this week.

- China’s industrial production rose at its weakest pace in a year in August – slowing to 5.2% growth year-over-year, from July’s 5.7% and missing forecasts of the same rate.

- Retail sales increased 3.4% year-on-year, below July’s 3.7% and analysts’ expectations for 3.8%.

- The data suggested that momentum in the world’s second-largest economy remained fragile despite earlier signs of stabilisation.

- Another month of disappointing Chinese data across the board may be creating a sense of deja vu, repeating last year’s slowdown around this same time," ING analysts said in a note.

- Still, Chinese stocks extended their rally, with gains in technology and consumer shares, boosted by upbeat AI sentiment in the U.S.

- The Shanghai Composite index inched up 0.2%, hovering just below 10-year highs, while the Shanghai Shenzhen CSI 300 jumped nearly 1%, remaining near an over-three-year high.

- Hong Kong’s Hang Seng Index rose 0.3%, staying close to a four-year peak.

- Meanwhile, China and the U.S. opened high-level trade talks in Madrid on Sunday, covering tariffs, export controls and digital economy disputes. The discussions followed a 90-day truce agreed in July.

- A day before the summit, China’s commerce ministry said it had begun an anti-discrimination investigation into U.S. trade policy over chips, and a separate investigation into dumping.

- The probes boosted optimism toward domestic Chinese chipmakers, as investors bet local firms could gain market share if tariffs or restrictions curb U.S. chip sales into China

- The region’s outlook would likely be shaped by U.S. economic data and the Federal Reserve’s rate decision later this week.

- Signs of a cooling U.S. labour market and still-firm inflation have left investors confident the Fed will cut rates by at least 25 basis points, a move that could boost risk appetite globally.

- South Korea’s KOSPI rose 0.6% to a fresh record peak of 3,420.23 points on Monday, led by semiconductor giants SK Hynix Inc (KS:000660) and Samsung Electronics (KS:005930).

- Investors also welcomed government signals of market reforms, including the postponement of proposed capital gains tax changes.

- Japan’s markets were shut on Monday for a public holiday, but remain near record highs.

- The Nikkei 225 has been lifted by technology and industrial stocks, mirroring gains in U.S. tech shares driven by AI enthusiasm.

- Elsewhere, Australia’s S&P/ASX 200 edged down 0.2%, while Singapore’s Straits Times Index traded flat.

- India’s Nifty 50 opened largely unchanged on Monday.

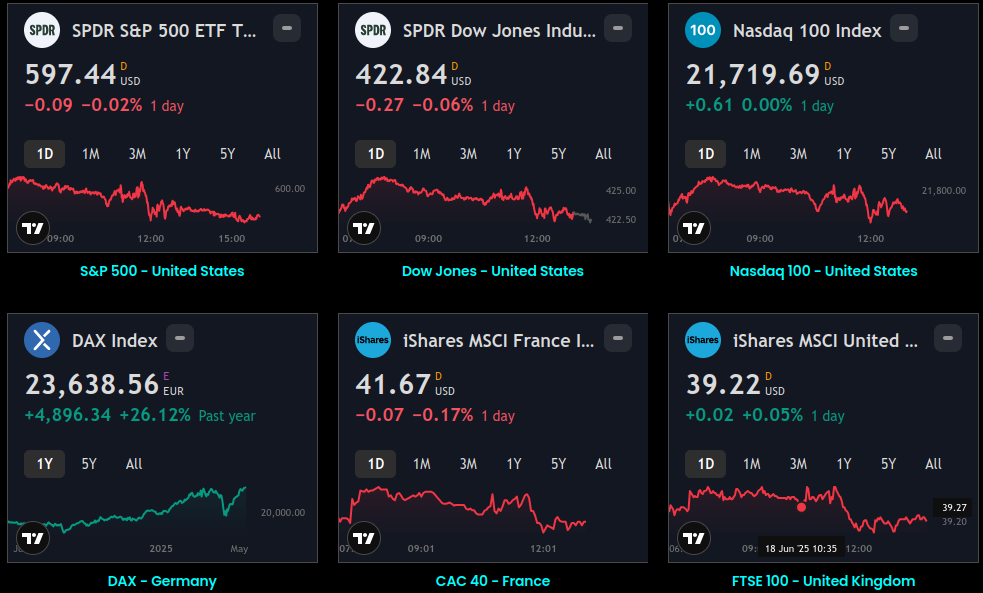

Market Close

- Equity markets rose on Monday ahead of the Fed's meeting this week in which the Fed is widely expected to cut interest rates.

- Communication services and consumer discretionary stocks led to the upside, while the consumer staples and health sectors were broadly lower, reflecting a risk-on tone to the trading session.

- Bond yields fell, with the 10-year U.S. Treasury yield at 4.04%.

- In international markets, Asia finished mixed overnight, as China's industrial production and retail sales growth for August were slower than expected.

- Europe was mostly higher, led by financial and real estate stocks. The U.S. dollar declined against major international currencies.

- In commodity markets, WTI oil traded higher following Ukrainian drone strikes on Russian refineries overnight.

- Despite inflation remaining above the Fed's 2.0% target, the central bank appears poised to resume interest-rate cuts for the first time this year, in support of its maximum-employment mandate.

- This month, the Fed will also update its quarterly economic projections for the fed funds rate, unemployment, inflation and economic growth. The June projection showed the fed funds rate dropping to 3.6% by the end of next year. Bond markets are pricing in a faster pace of easing, with fed funds falling below 3% over the same timeframe. The fed funds forecast — known as the “dot plot” — will likely be closely watched for signs that could point to accelerated easing to help support the labor market.

- Bond yields have moved lower recently, with the benchmark 10-year Treasury yield briefly touching 4.0% last week, matching the lows for the year reached in April. Lower yields have driven solid fixed-income performance. U.S. investment-grade bonds — which we believe should serve as the foundation of the fixed-income portion of portfolios — have generated 6.4% returns this year, outpacing their 4.9% average yield to start the year.

- As the Fed likely cuts rates in the months ahead, short-term Treasury yields — particularly those on T-bills — should drop along with the fed funds rate.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

This daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.

:max_bytes(150000):strip_icc()/GettyImages-22253320971-da13e4ba2de647db99b7a164cd72465b.jpg)