WTF Dailies October 08, 2025

US stock futures ticked up as Wall Street eyes the release of minutes from the Federal Reserve's September meeting.Gold broke records Wednesday night as it breached the $4,000 an ounce mark for the first time.

- US stock futures ticked up as Wall Street eyes the release of minutes from the Federal Reserve's September meeting.

- Gold broke records Wednesday night as it breached the $4,000 an ounce mark for the first time. The price has been continually pushed by fears over the US economy during the past year, accelerated by the government shutdown. The $4,000 price has been hotly watched as it marks a doubling of the value of the precious metal in two years.

- Traders are eagerly anticipating Wednesday’s release of the Federal Reserve’s September meeting minutes, which could offer new clues about the central bank’s internal divisions and the outlook for interest rates as the government shutdown deprives policymakers of key economic data.

- Last week, the September jobs report wasn't released as scheduled by the Bureau of Labor Statistics. The figures would normally give investors a sense of the Fed's next moves, considering the labor market plays a central role in its policy decisions.

- Meanwhile, the government shutdown, now in its seventh day, continues to breed uncertainty. So far, no end to the gridlock in Washington is in sight with President Trump backing Republicans' stance that no negotiations will be made with Democrats on the healthcare subsidies they hope to extend until the government is reopened. At the same time, Trump has threatened to withhold back pay for furloughed Federal workers.

- Most Asian stocks retreated on Wednesday with Hong Kong shares leading losses on a drop in technology stocks, while a stellar rally in Japanese markets now appeared to be cooling.

- Regional trading volumes remained muted on account of market holidays in China and South Korea.

- Asian markets took a weak lead-in from Wall Street, which fell from record highs amid a pullback in technology stocks, especially those linked to chipmaking, cloud services, and artificial intelligence.

- S&P 500 Futures rose 0.1% in Asian trade, remaining muted as markets awaited more insight into the U.S. economy from a string of Federal Reserve speakers this week.

- Global political jitters also spurred some risk aversion, as a U.S. government shutdown stretched on, while a political crisis in France deepened. Gold hit a record high above $4,000/oz in Asian trade.

- Hong Kong’s Hang Seng index was the worst performer in Asia on Wednesday, losing 1% in morning trade on losses in technology stocks.

- Losses in tech– after a strong run through the past two months– were driven chiefly by some doubts over AI, after an overnight report raised questions over cloud major Oracle’s (NYSE:ORCL) margins in the sector.

- Nvidia’s recent investment in OpenAI, coupled with a report it was investing $2 billion in Elon Musk’s xAI, also drove some concerns over circular investing in AI, which could present long-term risks.

- AI has so far been a major driver of tech stock gains in the past two years. But some doubts over the technology crept into markets this year, especially amid frothy tech valuations.

- Japan’s Nikkei 225 index was flat, while the TOPIX index rose 0.7%. Both indexes traded below record highs hit this week, after fiscal dove Sanae Takaichi was elected leader of the country’s ruling Liberal Democratic Party.

- Japanese stocks had shot up on Takaichi’s victory, which set her up for prime ministership. The LDP leader is widely expected to dole out more fiscal spending, cut income taxes, and oppose any more interest rate hikes by the Bank of Japan.

- But questions lingered over just how Takaichi will fund this fiscal bump, especially amid increasing unpopularity of Japanese government bonds among investors. The yen slumped after her election, as did bond prices.

- Japanese markets were also pressured by substantially stronger-than-expected household spending data for August. Strong spending is expected to further underpin inflation, putting more pressure on the BOJ to hike interest rates.

- Takaichi’s prime ministership could put the BOJ at odds with the government over monetary policy, given that BOJ Governor Kazuo Ueda has maintained the stance that interest rates will rise in tandem with inflation.

- Broader Asian markets crept lower amid weakness in tech and as global risk sentiment cooled. Australia’s ASX 200 fell 0.1%, while Singapore’s Straits Times index shed 0.4%.

- James Hardie Industries PLC (ASX:JHX) was an outperformer in Australia, rallying around 10% after the construction materials maker flagged a strong fiscal second quarter.

- India’s Nifty 50 index rose marginally in morning trade, remaining above 25,000 points.

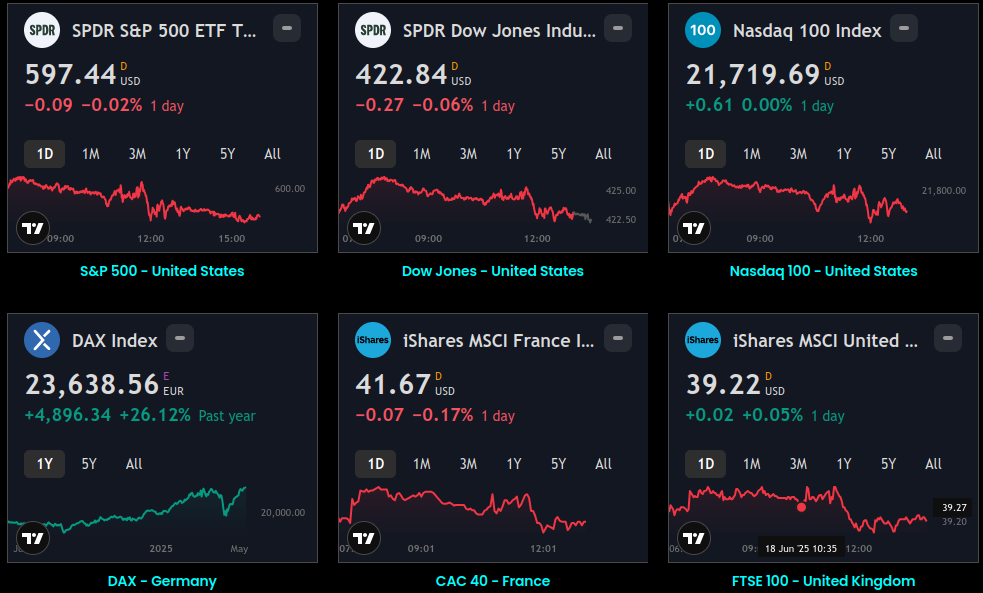

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

This daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.