WTF Dailies August 25, 2025

U.S. stock indices fell at the start of Monday’s session after Wall Street rallied sharply on dovish comments from Federal Reserve Chair Jerome Powell, which heralded interest rate cuts in the near-term.

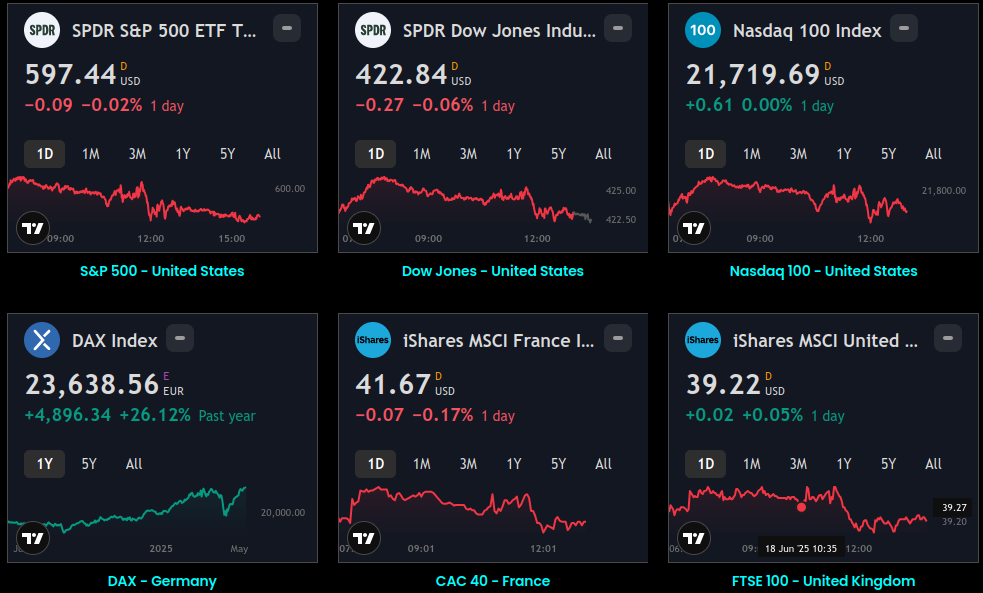

- U.S. stock indices fell at the start of Monday’s session after Wall Street rallied sharply on dovish comments from Federal Reserve Chair Jerome Powell, which heralded interest rate cuts in the near-term.

- In early Monday trading, the S&P 500 index declined 0.24%, while the NASDAQ Composite fell 0.4% and the Dow Jones Industrial Average dropped 0.2%.

- Powell, speaking at the Jackson Hole Symposium on Friday, said the central bank could possibly cut rates in September amid increasing risks to the labor market.

- Markets are now pricing in a ~89% chance of a 25bp rate cut in September, followed by a 49% chance of another 25bp cut in December.

- Focus this week is squarely on second-quarter earnings from AI major NVIDIA Corporation (NASDAQ:NVDA), which are due on Wednesday. The company is widely regarded as a bellwether for AI demand, and is expected to mostly log another strong quarter. But focus will be on the company’s China sales, which are likely to have fallen further amid brief U.S. export curbs and increased Chinese scrutiny towards AI chips. Nvidia was seen halting production of its China-specific H20 chip last week.

- Second-quarter gross domestic product data is also on tap this week, coming after preliminary data released in late-July showed strong growth.

- On the data front, the Chicago Fed’s National Activity Index for July is expected to come in at negative 0.11, down from the prior month’s negative 0.10. Meanwhile, new home sales are projected to have been at an annualized 630,000 pace in July versus the prior month’s 627,000 pace, corresponding to a 0.5% month-over-month (MOM) increase versus the prior month’s increase of 0.6%. The Dallas Fed’s Texas Manufacturing Outlook Survey for August will be released, with the general business activity index expected to come in at negative 1.7, down from the prior month’s 0.9. The finalized reading of July building permits will be released today, with the preliminary reading showing an annualized 1.35 million corresponding to a MOM decrease of 2.8%.

- Across the pond, European stocks are mostly lower in mid-day trading as Germany’s Ifo Business Climate Index for August increased more than expected.

- Overnight in Asia, stocks were higher as Japan’s nationwide department store sales in July declined by 6.2% year-over-year and the country’s finalized June Leading Index was revised slightly lower.

- In FOREX trading, the dollar is higher ahead of today’s U.S. economic releases.

- Over in the commodity pits, West Texas Intermediate (WTI) crude oil is 0.7% higher at $64.12/barrel amid worries over Russian exports due to potential additional sanctions from the U.S. and further strikes from Ukraine.

- In the metals complex, gold is 0.3% lower at $3,366.00/ounce following a strengthening dollar.

Market Close

- Equity markets finished lower on Monday, likely due to investor caution ahead of tech-giant NVIDIA's earnings. Leadership was driven by communication and energy stocks, while value-focused consumer staples, health care and utility sectors trailed.

- Bond yields rose, with the 10-year U.S. Treasury yield at 4.28%, though the benchmark rate remains below its July peak near 4.50%.

- In international markets, Asia finished mostly higher overnight, led by Hong Kong's Hang Seng index and China's Shanghai index, both of which reached new highs for the year.

- Europe pulled back despite a key measure of Germany's business climate rising for the eighth consecutive month to its highest mark in over two years.

- The U.S. dollar strengthened against major international currencies.

- In commodity markets, WTI oil moved higher amid geopolitical risks to Russian crude supplies due to Ukrainian attacks on energy infrastructure and the potential for additional U.S. sanctions.

- Earnings results from technology-giant NVIDIA will be in focus for investors this week, with the company scheduled to report results after the market close on Wednesday. Analysts expect NVIDIA to post earnings per share of $1.01, which, if achieved, would represent robust earnings growth of roughly 49% compared with the same period a year ago. Aside from earnings, investors will likely be looking to NVIDIA's revenue and outlook to assess the durability of demand for and investment in artificial intelligence (AI), which have driven technology and AI-related stocks higher. NVIDIA will largely round out what has been a solid earnings season, with 82% of companies beating analyst estimates by an average upside surprise of 8.0%.

- As a result, forecasts for second-quarter earnings growth of S&P 500 companies have been revised sharply higher to 10.5%, from 3.8% at the end of the quarter. Performance has been broad as well, with 10 of the 11 sectors reporting higher earnings year-over-year.

- Energy is the only sector for which earnings has contracted, representing less than 3% of the market capitalization of the S&P 500.

- Earnings growth is expected to slow over the quarters ahead, though combining for a solid 10.5% growth for 2025, aided by the first quarter's strong 12.8% rise. With U.S. equity markets near record highs, continued earnings growth will be key to help drive further gains over the remainder of the year, in our view.

- Personal consumption expenditure (PCE) inflation for July will be released on Friday, with the headline figure expected to hold steady at 2.6% annualized. Core PCE, which excludes more-volatile food and energy prices, is forecast to edge higher to 2.9%, from 2.8% the prior month. While PCE inflation remains above the 2% target, Fed Chair Jay Powell noted at last week's Jackson Hole Economic Policy Symposium that a "reasonable base case" is that tariff-related inflation will be short-lived, one-time shifts higher in prices. Powell also commented that labor-market softening may warrant adjusting the Fed's policy stance.

- Bond markets are pricing in expectations for two more cuts to the fed funds rate this year, likely starting in September, and an additional three cuts next year.

Global Indices:

Active Stocks:

Stocks, ETFs and Funds Screener:

Forex:

CryptoCurrency:

Events and Earnings Calendar:

This daily briefing is curated from a wide range of reputable sources including news wires, research desks, and financial data providers. The insights presented here are a synthesis of key developments across global markets, intended to inform and spark thought.

No Investment Advice: This content is for informational purposes only and does not constitute investment advice, recommendation, or endorsement.

Timing Note: Each edition is assembled based on the market context available at the time of writing. Timing, emphasis, and interpretations may vary depending on global developments and publishing windows.